As we continue to imagine life in a post-Covid world, there are several

industries that come to mind when considering what our ‘new normal’ will

look like.

One of these is insurance. More specifically, how insurance companies will

prepare and adapt to the next distribution channel.

It wouldn’t be overly bold to say that this model will not include the

same volume of face-to-face interaction that used to take place just under

two years ago.

As such, insurance firms have begun to face mounting pressure to adopt new

channels for customer communication, while still ensuring the same level

of customer satisfaction.

As McKinsey and Co. realized in June of 2020, “almost 50 percent of

[insurance] agents cited remotely building new customer relationships as the

biggest challenge during COVID-19”.

The need for digital tools is growing, but there is still limited public

awareness around what is available.

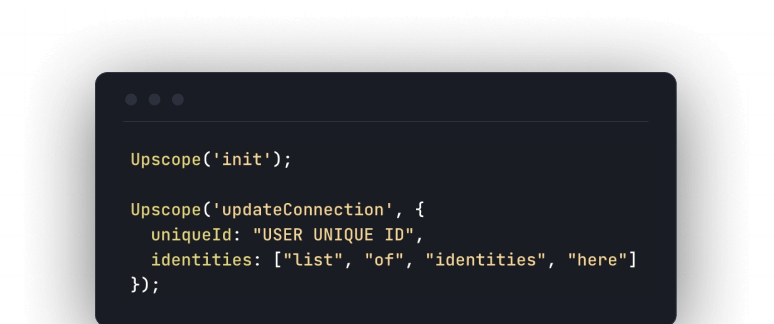

At Upscope, we’ve witnessed some of our biggest customers in the financial

services sector experience strong results with the help of co-browsing

services.

In many cases, our customers have decreased their average support times by

30%, and increased their first time call resolutions by over 20%.

But what fundamental problem does co-browsing actually solve for it to

produce such strong results?

Ask most customer support agents what their number one obstacle at work

is, and you’ll probably get a slew of answers that all relate to the infamous

‘support headache’.

The support headache most commonly occurs when the support agent and the

customer reach a dead end in their ability to communicate what they’re

seeing.

In other words, the barriers presented by remote instruction cannot be

alleviated by just the phone. As such, CSAT scores fall, retention rates

drop, and call times often become longer as a result of support

headaches.

Co-browsing is the power to see and interact with your customers'

screens instantly; no download required. Meaning that companies like Upscope

can break down barriers that the phone could not, eliminating the support

headache that your agents so strongly resent.

If you could have the ability to visually guide your customers through

their insurance queries, as if you were sitting right beside them, wouldn’t

you?

The adoption of co-browsing software may soon become a necessity for

insurance firms, as they - like all of us - look to boost their digital

capabilities in this new normal.