Underlying the loan origination process are issues of trust and education such

as clients focused only on the lowest interest rate when they should think

about the lowest monthly payment instead. They need help in trusting loan

officers, understanding terminology and completing the paperwork. Below we'll

cover the customer experience issues in mortgage banking and one key solution

that's emerging.

Solving the "what is the rate" mistake made by clients

One of the most common issues is clients asking for the lowest rate and then

only later realising there are many more variables involved.

There is piles of great advice in the following

video and here are some

key points:

-

The client does not know what to ask if they're just asking for the

rate. -

They're asking 'whats the value but as they don't know how to measure the

value, they ask about the rate'. -

One way to frame it is to "Give you a total cost analysis". Give easy to

read charts and analyses. Show total equity or wealth under each of those

strategies. -

"A mortgage is not a rate and a payment, it's a strategy"

-

Ask whether "your last mortgage brought you closer to or further from your

financial goals". This helps unveil where their thinking is at. -

Ask, "what's important - the lowest interest rate or the lowest payment."

-

Understand their big picture goal.

A great summary on the same subject from the following post is as

follows:

"Many people think mortgages are all about the interest rate, and thus believe

"the better the interest rate the better the deal."

"These same people are the ones going lender to lender asking “What is your

rate?” only to get frustrated when they don’t hear hard numbers in return.

What these same people don’t realize is there are many ways that someone

paying a 4.99% can actually be getting a better deal than someone paying

4.75%. Simply put, there are more variables to compare. Some are price

related, while others are no."

Below is the simple explanation of why customers should

care

about the monthly payment more than the interest rate even if they don't know

it:

"I tell loan officers that their customers do not care about the rate. They

care about their monthly payment (yes, they are related)."

"Most of their customers do not know what a reduction of .125% in rate will do

to their payment, especially after taxes. So, the quicker the conversation

converts to payment (or something else that may be important to them), the

more successful they will be."

What can we conclude from the key points taken from above videos and docs?

There appears to be a big gap in understanding the terminology and numbers

that make up the actual monthly payments over time. There's a

misunderstanding of the role the interest rate pays compared to the rest of

the variables.

Customers don't entirely trust loan officers and just want the interest rate.

Whoever succeeds in educating the customer quickly and effectively, in an

engaging manner, will likely hold their attention to the close because they'll

understand then numbers and they'll then trust the loan officer.

The experience of getting an approval is also broken

The application process is rarely simple because making what's likely to be

the biggest purchase of your life involves several steps and paperwork.

Here is some key notes on problems caused by pushing clients into the system

from the following 'day in the life' of a loan

originator:

-

"My job is to structure your loan."

-

It's total nonsense to fill out a form and get an approval. The problem is

that only 20% of those applications are correct because people don't know the

guidelines that loan officers have to follow. -

Speaking to underwriters helps understand what they are looking for e.g.

they're looking for different types of fraud. -

Some loan officers are just app takers - they get it filled out and pass it

on. -

Some officers are barely looking at pre-approvals. They just push it into

the computer and let it blow up.

Even once you're in the system the experience is clearly dependent on

completing a number of additional steps of which a new buyer is not familiar

with.

What are the key questions going through the client's mind?

From the above, you can see that the underlying questions going through the

clients mind are:

-

Do I like this person?

-

Do I trust this person?

-

Do they know what they're talking about?

-

Does this person actually understand my goal or are they just in it for

them?

In response:

-

The loan officer has to structure the call to communicate back to them that

they're the person who can add value. -

They have to take the lead because they're the professionals.

-

They figure out where the client is at and are able to rapidly summarise

what the problem is that they can help client with.

The words they use and the methods they apply to engage and educate the

customer become critical to answering those doubts.

What are the skills a mortgage banker needs to help clients?

Educate, advise, consult and other words are mentioned often in mortgage

banking job descriptions. Below are key requirements of one such job posting:

-

Advise and educate clients on the home-buying or refinance process and how

to better manage their mortgages. -

Assist clients through the loan process from application to closing.

-

Consult with our clients about current and future needs in achieving their

financial goals. -

Interview clients to gather information about their unique financial

situations, needs and objectives. -

Educate and advise clients on the home buying process and how to best manage

their mortgage(s). -

Explain the different loan options to clients and guiding them through the

application process.

"mortgage banking is very much a high-end sales position, but not in a “pushy

used car salesman” kind of way. It’s about developing relationships and

finding the best loan option for clients looking to buy real estate."

If understanding needs and educating clients is a a key part of the customer

experience and the job requirement then why not have the methods and processes

in places to do exactly that.

One proven process that builds trust and educates the client

An industry even tougher than mortgage loans is the debt relief industry. An

individual being chased by debt collectors is already wary when the phone

rings and convincing them to put aside money into a new bank account is a

challenge.

Freedom Debt Relief had this problem. Customers didn't understand the process

and the terminology involved and required a lot of guidance to trust their

agents.

When a client filled in the form on the Freedom website they were immediately

called by a team member. How did Freedom help clients understand and trust

them?

-

During the call they emailed a unique link to the client's email address.

-

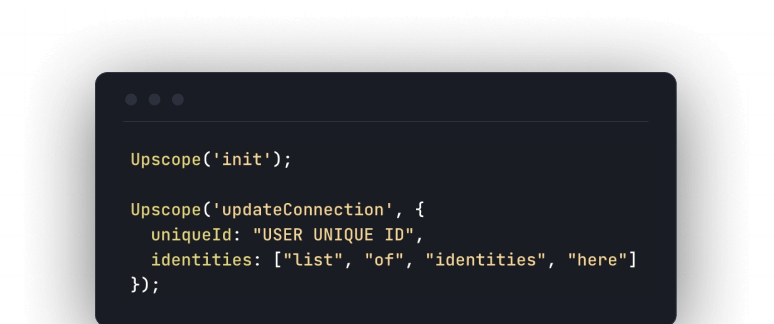

The client clicked the link and it started an interactive Upscope

co-browsing session. This is a bit like screen sharing

but without downloads and where the team member can click and scroll on the

client's screen. -

The link opened up a presentation on how the loan process worked.

-

The team member took the client through the presentation, explaining the

terminology and how the process worked while clicking for the client on their

screen as if they're sitting right there next to them. -

The client, now understanding the process through the visual presentation,

became far more likely to continue and close on the loan.

When the key issue is trust, education and needing guidance through processes,

it's helpful to do more than talk to someone over the phone.

You need software which fixes the core problem of 'being on the same page' and

that's what Upscope co-browsing does.

It's a unique process because of the following factors:

-

Unlike screen sharing, it does not require downloads or installs.

-

Unlike screen sharing, it's interactive. The team member's mouse cursor

appears on the client's screen and is seen to be clicking for the client as

the team member explains key terms. -

It's securely limited to just the page on which the client needs help on,

the team member can't see other browser tabs or the desktop. -

Freedom Financial were able to add customized notes to each page so that

agents knew what to say to clients depending on their specific circumstance.

Explore Upscope co-browsing here and get a demo to

discuss how Upscope has already helped companies educate clients and improve

close rates.